(资料图片)

(资料图片)

LONDON, July 11 (Xinhua) -- The average two-year fixed mortgage rate in the United Kingdom (UK) increased to 6.66 percent on Tuesday, reaching its highest point since August 2008, data provider Moneyfacts said.

The recent rise in mortgage rates was due to volatile swap rates, Moneyfacts added. "Much of this is driven by recent inflation figures, which remain stubbornly high and suggest the Bank of England (BoE) may need to make further base rate increases."

UK inflation rose by 8.7 percent in May, unchanged from April. To combat high inflation, the BoE raised its benchmark interest rate to 5 percent in June. It was the 13th consecutive rate hike since December 2021.

The UK housing market has cooled amid higher interest rates. The average house price fell by 0.1 percent in June, a third consecutive monthly decline, according to mortgage lender Halifax.

"The resulting squeeze on affordability will inevitably act as a brake on demand, as buyers consider what they can realistically afford to offer," Kim Kinnaird, director at Halifax Mortgages, said.

"While there"s always a lag effect when rates go up, many existing mortgage holders with variable deals or rolling off fixed rates will likely face an increase in the next year," Kinnaird added.

检察官担任法治副校长有了“指挥棒”

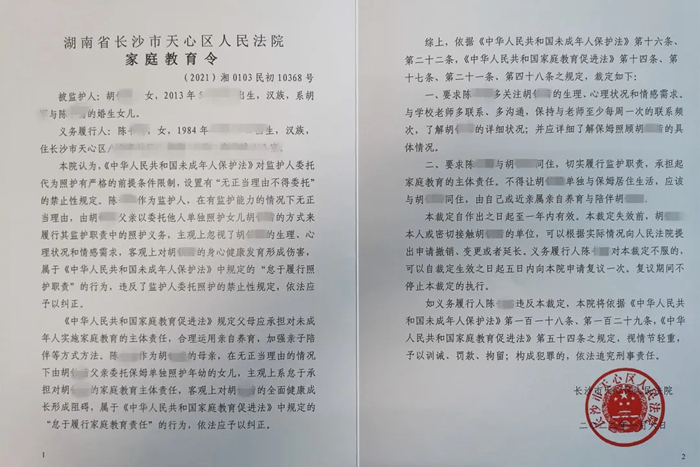

检察官担任法治副校长有了“指挥棒” 全国首份《家庭教育令》来了!督促家长“依法带娃”

全国首份《家庭教育令》来了!督促家长“依法带娃” 俄军装甲车辆将具备隐身能力

俄军装甲车辆将具备隐身能力